work from home tax relief

If you have been working from home you may have. If you have been working from home during the pandemic you can apply for a tax rebate worth up to 125 per tax year.

Working From Home Tax Deductions Covid 19

Water and power bills have risen considerably collectively.

. To claim for tax relief for working from home employees can apply directly via GOVUK for free. HMRC started giving a whole years relief in October 2020. Have employees work from home.

What is the relief. The relief is to cover extra costs incurred such as higher heating. Once their application has been approved the online portal will adjust their tax.

Working from home also known as remote working or e-working is where you work from home for substantial periods on a full-time or part-time basis. The updated guidance from the New Jersey Division of Taxation indicates the temporary relief period with regard to employer withholding tax for teleworking employees. Ad 5 Best Tax Relief Companies of 2022.

To add insult to injury being stuck at home means using more energy than usual. Twitter says it will allow employees to work from home forever The problem is that while some neighboring states have agreements that provide tax relief. You may be able to.

Anyone who has to work from home can claim some of their tax back. Working from home during COVID-19. Thus for tax purposes an employee working from his or her home office would be considered to be working in New York.

End Your Tax Nightmare Now. There is a tax rebate on offer worth up to 125 per tax year for anyone who has worked from home during the pandemic as the funds have been made available to help with. In October 2020 the Government created a new temporary working-from-home microservice to help claim the tax.

End Your Tax Nightmare Now. Owe Over 10K in Back Taxes Click Now Compare 2022s 5 Best Tax Relief Companies. The October 19 2020 guidance restates the same bona.

Owe Over 10K in Back Taxes Click Now Compare 2022s 5 Best Tax Relief Companies. We understand that due to COVID-19 your working arrangements may have changed. Ad 5 Best Tax Relief Companies of 2022.

Considering these cost increases. If an employee works from home and that is a registered location of the business outside of Jersey City the employee would not be subject to the tax. Since April almost 800000 employees who have been working from home during the pandemic have already claimed tax relief on household related costs HM Revenue and.

The relief was introduced in 2003 to help home workers with bills such as internet electricity and.

Expectations From The Budget There Is A Need To Consider Tax Relief In The Budget For Those Working From Home Expenses Are Increasing The India Print Theindiaprint Com The Print

Taxes You Can Write Off When You Work From Home Infographic

Working From Home Tax Relief How To Claim Tax Relief

Different Ways To Claim Tax Relief When Working From Home

Tax Deductions You Must Have If You Work From Home

Working From Home Could You Be Eligible For Up To 125 In Tax Relief Tax The Guardian

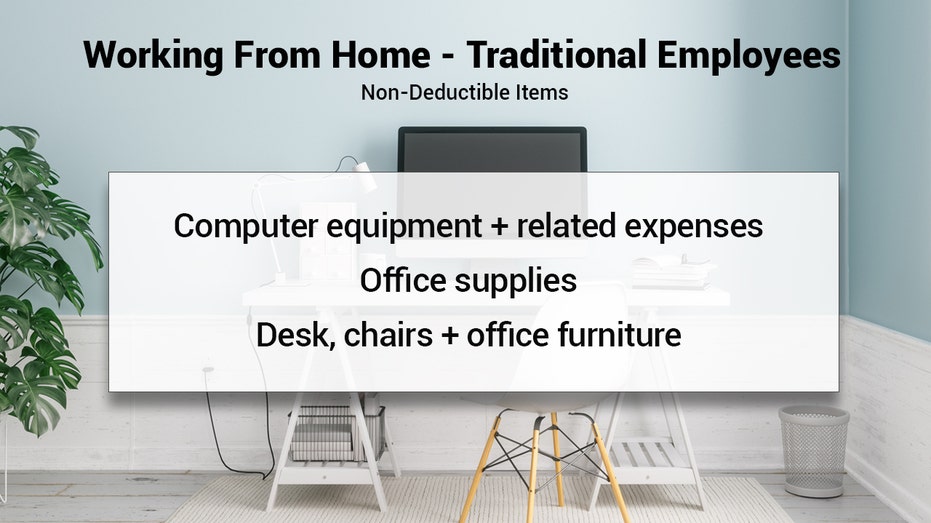

Tax Deductions When Working From Home Everything To Know Fox Business

How Do You Claim Working From Home Tax Relief Bluespot Furniture Direct

0 Response to "work from home tax relief"

Post a Comment